Hi, I'm Adrian

I occasionally post about anything I do. This blog is just a reflection of my personal experiences, and I use it to clear my thoughts. If you have some corrections or additions, feel free to contact me!

Enjoy,

Adrian

Adrian

Latest Projects

View all →

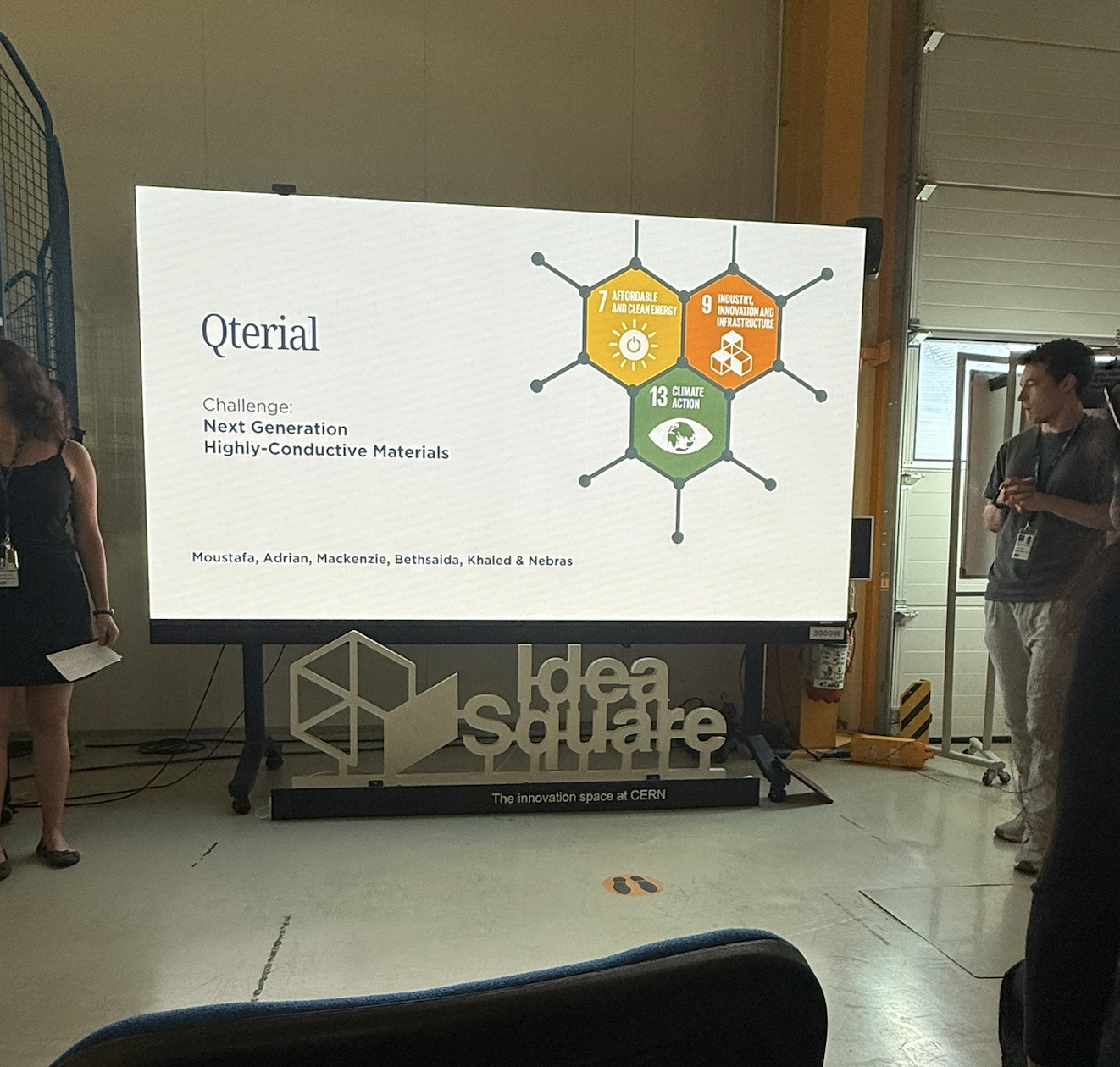

Quantum Materials Hackathon - Superconductivity - CERN / ETH

Background During my time as a summer research student at CERN in Geneva, I participated in a Qu...

July 2025

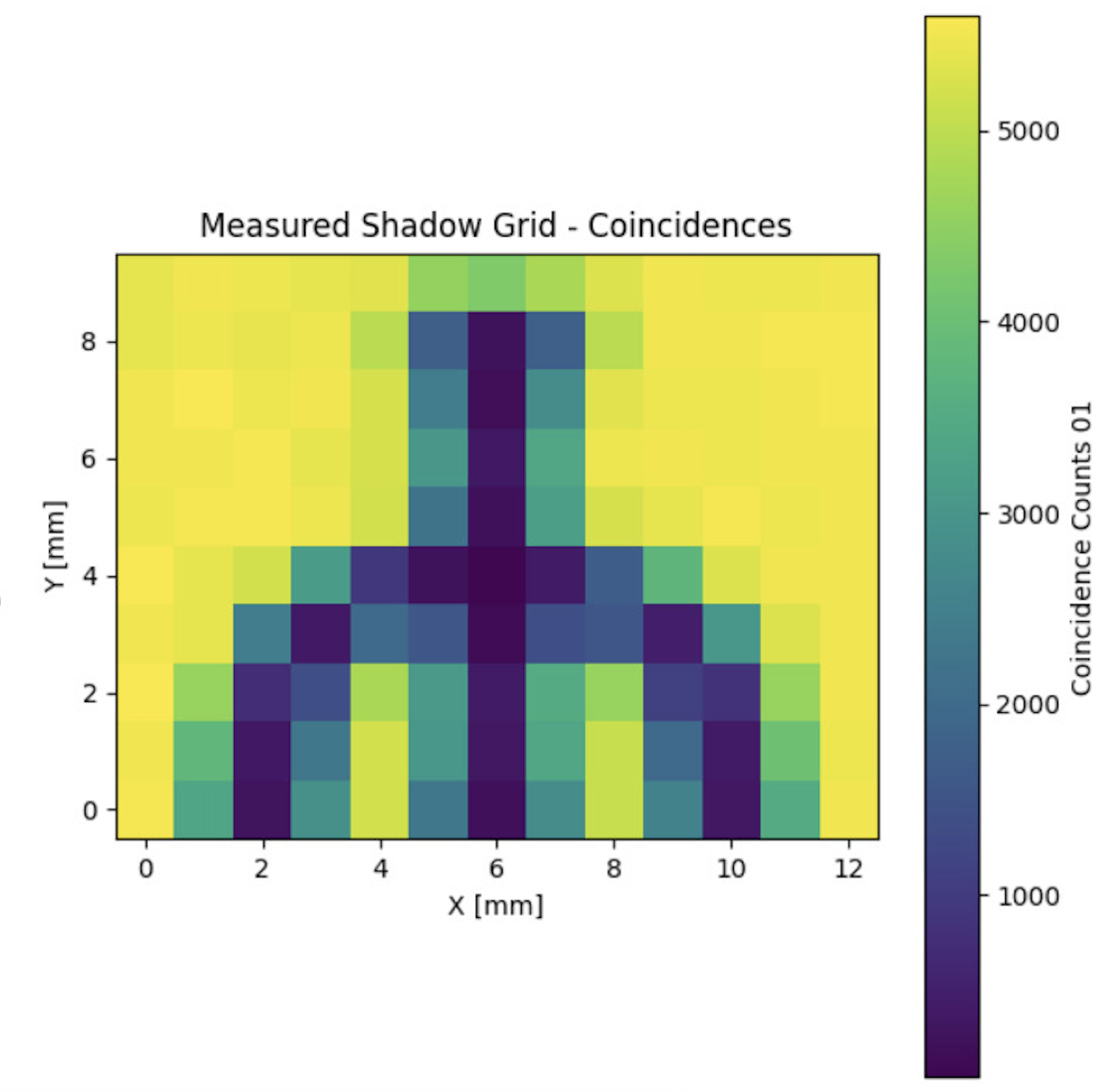

Quantum Ghost Imaging: Creating Images Through Quantum Correlations

What Is Ghost Imaging? Quantum ghost imaging is a counterintuitive technique that uses spatially...

May 2025

Latest Writing

View all →