Current macroeconomic trends are fascinating to watch, but scary at the same time. Over the next months, many different outcomes are possible, depending on how current issues like the Ukraine war and the rising inflation play out.

Note: This is just my personal view. My knowledge about macroeconomics comes from random YouTube videos and Tweets. However, I want to mention Raoul Pal and Tasha Labs. They provide incredible insights which taught me a lot.

General takes about Macroeconomics

Macro is mainly ruled by two assets – the US dollar and US treasuries. Therefore, the following post will primarily focused on these assets. Western banks align themselves mostly on what the Federal Reserve (Fed) does, so the analysis of these wouldn’t be much different.

Three targets of the Fed:

- keep prices stable

- limit unemployment

- promote economic growth

Getting an overview of the current macroeconomic situation is hard, because plenty of factors are involved. However, there are certain indicators that helped in the past. These are the most important ones:

- Gross Domestic Product (GDP): the dollar value of all final goods and services produced within a country in one year

- Unemployment Rate

- Consumer Price Index (CPI): market basket with the same products every year, used to measure inflation

- GDP Deflator: like CPI, but measures all goods produced

Current Situation

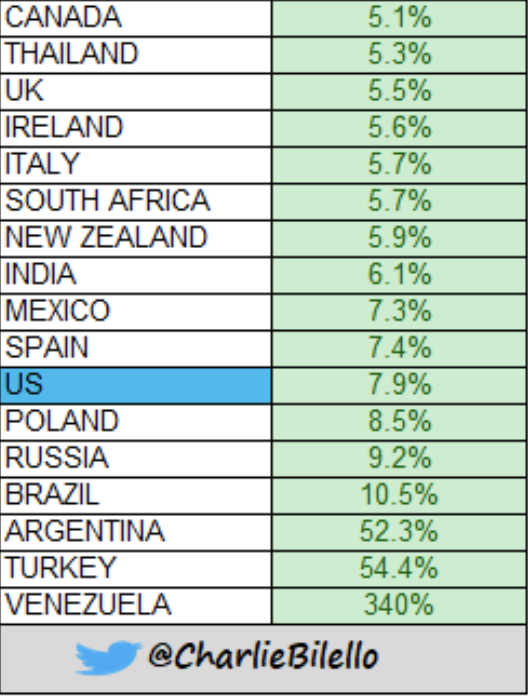

We have historically high inflation- not just in the US:

This puts a lot pressure on the working class. But what causes inflation? There are 3 reasons:

- Central banks prints to much money (Quantity Theory): supply of money rises

- Demand-Pull Inflation: overheated economy with excessive spending but same amount of goods

- Cost-Push inflation: negative supply shock increases the costs of production

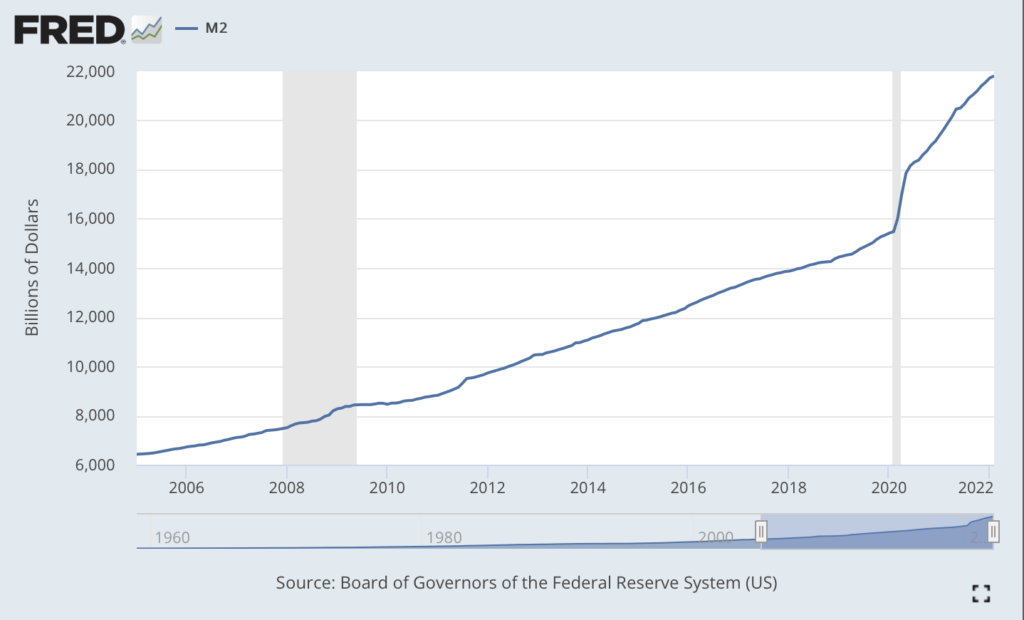

Since the corona pandemic in 2020, the fed massively increased their balance sheet, which “printed” a lot of money (I know, economists don’t like this word). Furthermore, three stimulus checks where sent to most Americans. Because of these reasons, the money supply M1 increased massively. 80% of all Dollars in circulation where created since January 2020 [Source]. The M2 money supply also grew a lot:

But not only the money supply increased. Due to global lockdowns, production of goods and services were stopped. This resulted in bottlenecks in supply chains which occurred in many industries.

The Ukrainian war triggered a parabolic rise in raw materials over the last few weeks, especially in gas, oil and wheat. This will put even more pressure on society.

How it could play out

Inflation needs to go down. There are two ways to do it:

- economic growth

- raising interest rates

With economic growth, the supply of product and services increases, therefore the prices should go down. But short term economic growth seems unlikely. Even if we don’t run in lockdowns anymore, bottleneck supplies need time to resolve. Many people say it holds on until 2023.

Raising interest rates is an option to reduce the money supply which resolves in less spending activity. But it also reduces economic growth. In the current times, this is a risky path. If interests were raised too sharply, a stagnation seems very likely. It could even turn into a recession. Unemployment rate will rise, the working class will be even worse off.

Last week, the Fed announced that they raise interest rates from 0% to 0,25%. Compared to the past, this is still really low. But more raises are planned, the Fed is even “prepared to raise interest rates aggressively”, says Jerome Powell.

Some politicians also discuss the option of a fourth stimulus check. However, this could make the situation even worse. Yes, in the very short term, people would have more money to spend, but it wouldn’t change anything afterwards. It’s like a drug addict taking another shot to escape the withdrawals. It would only lead to bigger withdrawals, which in our case would be a stagnation/recession.

In a recession, the Value of a US dollar rise, due to reduced business activity. Prices of Oil, Gold, wheat, etc. will rise as well.

We see these things even today. Another indicator of a recession is when the yield curve inverts, where short-term bonds have higher yields than long-term bonds:

It’s closely to zero, indicates an upcoming recession.

In conclusion, the indicators signal towards a stagflation, even a recession. A large raise in interest rates could make the situation even worse. On the other side, inflation will continue to raise with current interest rates and market conditions.